Flat Fee Payroll Services at Fireside Tax

Are you a Canton or Massillon based small business? Even if you’re not, we can still help you manage your payroll needs! We currently help many small Northeast Ohio businesses manage their payroll so that they have more time to focus on their business rather than the entire payroll process.

View our Payroll flyer! Click Here

*Please note that prices listed on the flyer are subject to change.

When you use the Flat Fee Payroll Services at Fireside Tax, we provide you with the paystubs, the register, and the tax collection receipt each time. You will know in advance exactly what we will withdraw from your payroll account.

If your employees are not registered on the portal to view their paystubs, you should print and distribute the paystubs to them. Alternatively, skip printing and provide email addresses for each employee so they can view and print their paystubs whenever they need.

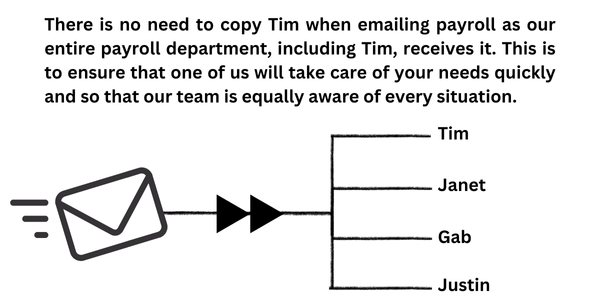

When you submit payroll information to the payroll email, organize employees alphabetically by last name. This helps our team process your information more quickly and accurately.

Your payroll may be seasonal, but a reliable payroll service operates year-round.

We understand that your business operates on a seasonal basis, but it’s important to note that payroll services are essential year-round. Even during the off-season, there are several key filings and tasks that need to be maintained to keep your business running smoothly, such as quarterly 941 filings and preparing W-2s for your employees.

Our payroll system and support are active throughout the year to ensure compliance with these ongoing requirements. This helps prevent any gaps or delays that could disrupt your operations when your business is in full swing.

Holidays Affect Direct Deposit!

When a bank holiday falls within a payroll week, add an extra day to your process. During a normal week you submit hours worked on Monday to be paid on a Friday. During a holiday week, to be on time for direct deposit you need to submit a day early so if you normally submit on a Monday you would need to submit the information on the Friday before. You can just write paper checks for that pay to avoid any headache.

If a holiday falls on a day other than your pay date, run payroll one day earlier than usual to ensure employees are paid on the scheduled pay date. For Standard 4-Day processing, run payroll at least five days before the pay date. If you normally turn in your information on a Monday, submit it the Friday before.

If a holiday falls on a pay date, employees will not be paid until the next banking day. To avoid this, pay your employees one day earlier, which means running payroll one day earlier. You can either credit unworked hours to this pay or bump them to the following pay period.

Unable to submit the information early?

You will need to handwrite checks for that pay period for your team.

Get started with the Flat Fee Payroll Services at Fireside Tax

TIPS FOR SUCCESS

✔️ Provide Fireside Tax with an email address that isn’t overwhelmed with other emails. Attach this email to your smartphone to receive instant notifications about any payroll updates.

✔️ Read the emails we send you and review all attachments. If you aren’t tech-savvy, assign a trusted team member to handle this for you.

✔️ Use online banking for direct deposit and accounting. You don’t need to access it constantly, but it’s important to log in and monitor your accounts.

✔️ Be open to change. We know you may have processed payroll a certain way for many years. While we strive to accommodate you, adapting to new methods leads to better success. Our most successful clients are flexible, ask questions, check in often, and read our emails. We’re always here to explain any charges you might not understand.

✔️ During pay week, move all relevant funds into the payroll account by Monday (or 5 business days before payday if there’s a holiday). Ensure payday is a non-holiday and business day. Otherwise, we will move direct deposit to an earlier date, affecting your transfer schedule. (If you write checks, only the tax withdrawal date matters, which is usually the day before payday.)

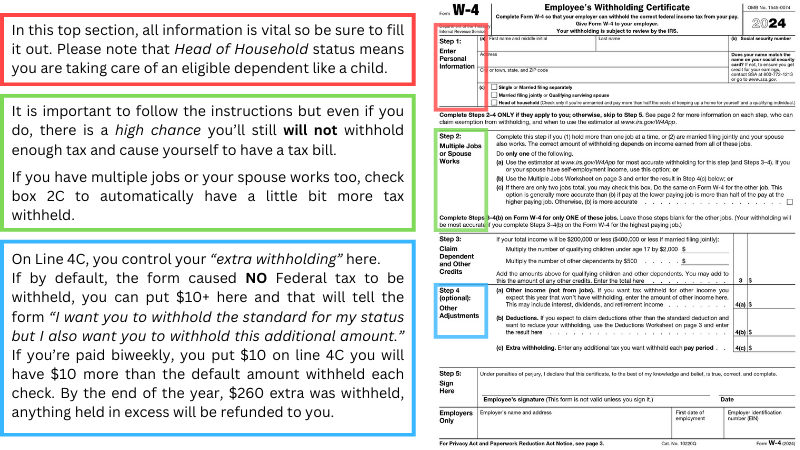

✔️ Inform your employees that the W4 Form changed in 2021, and many people may not have Federal tax withheld naturally. If they are full-time, they should put a small amount in Line 4C of the W4 form. We offer W4 appointments to review their tax liability and determine the necessary withholding per pay period.

✔️ Notify us if your address changes! Payroll, BWC, and other organizations need your current address.

✔️ Report New Hires Immediately – Fill out the new hire packet and submit to Fireside Tax as soon as possible. Ohio law states: Employers who fail to report new hires in the proper timeframe may receive fines of up to $25 per new hire that was not reported. If it is deemed that failure to report was intentional on behalf of the employer and employee, fines can reach up to $500 per new hire that was not reported.

✔️ Submitting payroll info on Monday is great, but submitting it on Sunday will get you served first thing Monday morning. We love that!

Flat Fee Payroll Services at Fireside Tax: More Templates

New Hires

2024 New Hire Packet

Hiring A Minor

- Read this before doing anything…Click here

- Post this in the workplace

- Your minor new hire needs to fill this out

W4 Guide

Any employee that has My Patriot login https://id.mypatriot.com/ can log in and update what they want withheld at any time.

You log in then go to “Federal Tax” click edit and make the changes there.

Why Isn’t Enough Federal Tax Being Withheld?

The W4 form was updated in 2021, and the old “claim zero for maximum tax withholding” is no longer valid at the Federal level. Many people end up owing because of these changes, so it’s important to review your W4 carefully.

We recommend manually entering an amount on line 4C for EXTRA federal tax withholding, based on what you can afford each pay period.

For example, if you owe $2,000 in federal tax and get paid biweekly, you should withhold at least $77 per pay and if your paystub is not reflecting that amount then you need to adjust the Form W4 and increase the withholding on line 4C.

Adjust your W4 to ensure the right amount is withheld and to avoid owing at tax time. To help, you can schedule a W4 adjustment appointment with Fireside Tax. For $35*, we’ll estimate your potential tax bill and help adjust your W4 accordingly. Just bring your most recent paystub and last year’s tax form.

The IRS also offers a tax withholding estimator here: https://apps.irs.gov/app/tax-withholding-estimator

*Price subject to change

Ohio BWC – Worker’s Compensation

Did you know?

- If you have a workers comp claim it needs to be reported to your MCO/BWC within 24 hours or 1 business day of the initial treatment?

- Save 2% on your total BWC cost by paying annually!

- You also have the option to break the payment into monthly or semi-annual installments. However, there’s only a small window each year in May to make these changes!

On your New Hire Packet, you’ll find a BWC code to assign to each employee. These codes are typically assigned to you, so you’ll need to contact your Ohio BWC representative for assistance, or you can look up the codes yourself. Each employee needs a code based on their position—like a dishwasher has a different code than a waitress, and these codes may come with different rates.

We will review these records with you once a year, usually in early summer, for all your employees, past and present.

Why is this important? It helps the Ohio BWC assign the most accurate rate, which can often lower your costs.

Make any changes to your BWC payment frequency between May 1st and May 15th to keep your payments convenient.

Need to cancel your BWC policy? Do so before July 1st (or the specified date) of the current year to avoid being held responsible for the full premium. It’s essential to maintain your coverage—having it is always better than having to explain why you don’t!

💡 Stay in touch with your BWC representative to get the best rates for the specific jobs you and your team perform. Then, update Fireside Tax with any changes.

Ohio Business Gateway

Handle Sales Tax & More!

Ohio Unemployment

What is FUTA & SUTA?

Unemployment insurance taxes are made up of both FUTA (the federal unemployment insurance tax) and SUTA (the state unemployment insurance tax). Your unemployment insurance tax rates are set at both the federal and state levels.

City Tax

Time Clock

Timekeeping is available for weekly & biweekly employees

On the New Hire Packet – email is required!

Employees Securely clock-in with their browser based employee portal

Time Punch Entry and Manual Entry is available!

Easily Approve and make notes on time cards!

Employers: PLEASE APPROVE TIME CARDS on SUNDAY and fully log out!

Child Support

We can easily handle your employee’s child support payments. We charge a poundage fee (starting at $2.00, depending on complexity) and withhold this cost from your employee, billing you once a month.

We send the payments online and deduct the amount from your payroll account on the day before payday, on payday, or the next available day.

EMPLOYERS, TAKE NOTICE:

If an employee faces layoff, termination, or a leave of absence without pay, notify the CSEA in writing within 10 days. Include the employee’s last known address and any information about a new employer or income source.

Also, remember to inform the payroll department that the employee is no longer working for you!

Manage Vacation Time

Click Here to see the vacation time formula that we can easily set up and let your employees start earning vacation time. An example rule would be For every 40 regular hours worked, an employee earns 1 hour of vacation time. You can cap the max hours earned and you can limit how much time carrys over into the next year.

1099s

DO NOT let anyone work for you without at the very least have them fill out a W9 Form. This generally protects you and your company.

Here is what happens if you don’t have a new non-w2 wage employee fill out a W9: Read this

After a list is made (use the template) 1099s are generated and sent via our portal just like W2s

The responsiblity is ultimately the employer’s to get these documents postmarked by January 31st every year. We will print and mail for you for a fee.

On QBO Run a Transaction List by Vendor report for the tax year, upload here

W2s

Every January, Fireside Tax will send an unofficial W2 and W3 Summary via the Portal. Please review these with your employees:

- Name spelling

- Current address

- Social Security Number (Use the verification tool linked above)

- Spot if any Pay discrepancies

Notify Fireside Tax of any issues by phone or email before January 10th. After this date, making changes may incur fines/fees, which we will pass along to you.

Fireside Tax will send out finalized W2s via the Secure File Pro Portal. Printing and mailing the PDFs will incur additional fees.

As soon as the PDF file is available in the Portal, you will receive an email notification to log in and download it. You need to postmark the W2s by January 31st each year if not delivered electronically directly to your employee via the Patriot Portal.

Encourage your employees to sign up for the My Patriot portal by clearly labeling their email on their New Hire Packet and selecting “Electronic W2 Delivery” when they register. This saves you time and costs. While it’s good practice to provide a paper copy even if an electronic copy is given, it is not required as long as the electronic W2 has been received.

Side Note to Employers: We use two different portals. One is run by Drake Software, Secure File Pro, which you will use to receive your W2s and W3. The other, My Patriot, is for employees. As an employer, you may have additional access with Patriot Software for managing time cards and other tasks. This is a separate access from the My Patriot Portal.